Medical Takaful

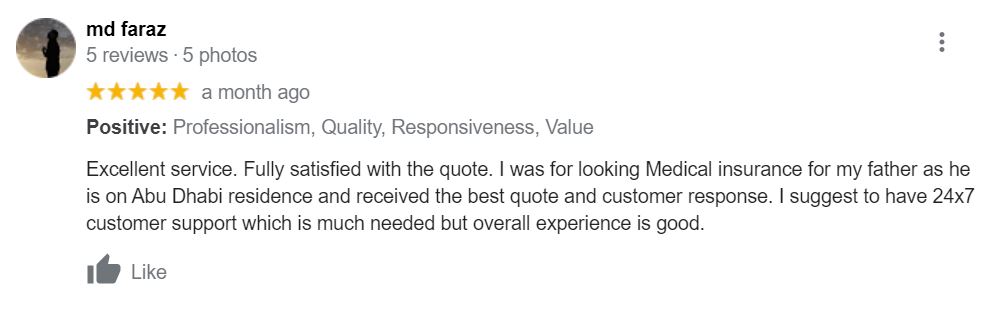

Good health is a blessing and we want to be your partner in illness & wellness. Takaful Emarat offers enhanced health+ plans which come with worldwide coverage & countless health benefits.

Life Takaful

As life goes on, your priorities and needs change which is why we have tailored Life insurance plans that suit you and those you care for. Our Shariah-compliant products will grow with you and ensure a financially independent future.

Aligning with Dubai 2021 Vision for Excellence

We share the same flair